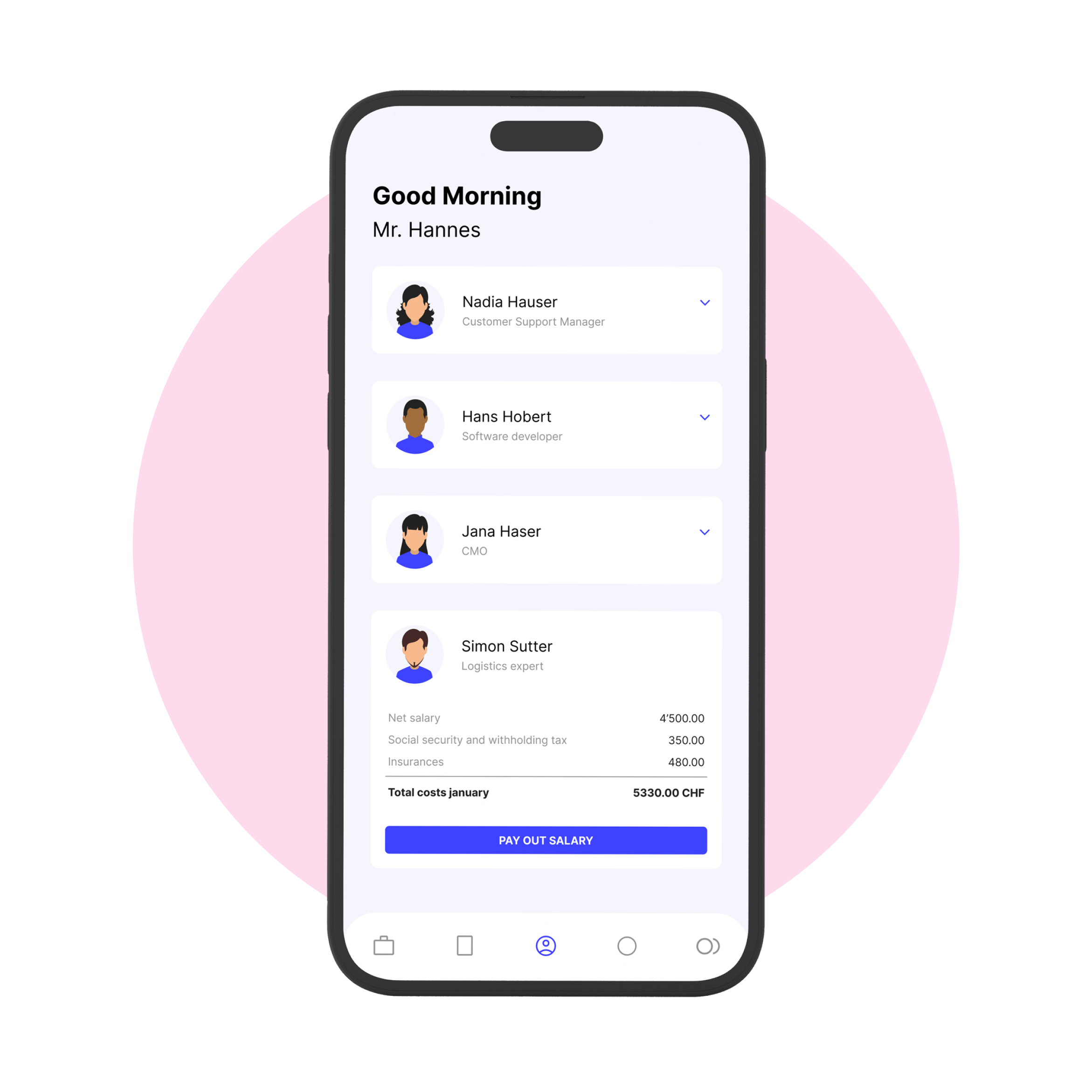

Award winning app

Fulfill legal obligation.

And a little more when needed.

Accident insurance (UVG)

UVG covers the results of an occupational accident, non-occupational accident or occupational disease.

Minimum fee of CHF 200

Pension fund (BVG)

The occupational pension plan (2nd pillar) supplements the AHV pension (1st pillar) to ensure an adequate standard of living after retirement.

Sick pay insurance (KTG)

This insurance assumes your obligation to continue paying wages in case of illness of your employees. At the same time, your employees are protected against loss of wages.

Minimum fee of CHF 500

UVG +

Improvement of UVG through coverage of costs of private hospital treatment and additional protection against benefit reductions through coverage of special risks.

Minimum fee of CHF 200

Our partners.

Carefully selected.

We are proud partners of Helsana and NEST, which offer their customers high-quality services with high customer satisfaction or rather sustainable and ethical pension solutions.

Your contact

Nadia Monnier

Ready when you are.

Also for consultation.

Sign up today or let us help you. Book an appointment online and we will call you.

Trusted by various customers:

Any questions?

Based on your information, quit Business knows what you need. We decide for you which authorities to register with and what social security contributions are due on your employment. We make sure that the employment is managed professionally and socially fair.

Compulsory insurances

- Cantonal compensation offices

- All social security contributions like AHV, IV, EO, ALV and FAK

- Accident insurance (UVG)

- Always: occupational accident insurance (BU).

- From 8h/week per employee: non-occupational accident insurance (NBU).

- Pension fund

- From an annual salary of CHF 21’510 per employee.

- Employment contracts limited to three months are excluded.

- Sick pay insurance (KTG)

- Tax offices

- For employees liable to source tax (not CH-citizens or C-card).

Voluntary supplementary insurance

- Supplementary accident insurance hospital private + gross negligence

CHF 19 per employee per month. Added to this is 0.1% per insurance policy taken out of the total gross payroll settled.

There is no service comparable to quitt Business. We are an automated and specialized online trustee that takes care of everything related to hiring and billing employees, without you having to hire internal or external staff.

Here, you save time and money:

- Trustee

- We take care of all administration and communicate with all authorities: register, settle accounts, pay invoices and support you in all matters concerning your employment.

- Every year, we update all tariffs from all our partners, compensation offices and authorities in all cantons.

- HR

- Payroll: quitt Business saves you the trouble of downloading the payment file from the accounting department, uploading it to online banking and triggering it. Regardless of whether regular or hourly employment.

- New employment: No need to send around the personnel master data sheet. With quitt Business, you only enter the mobile number of the person to be hired.

- Pregnancy, child allowances, military, illness: no problem with quitt Business. Just press the “child allowances” button in the app. We know what to do – and do it for you.

- Legal advice:

- Based on your information, we create employment contract, team contract and expense regulations (plus over 10 other documents).

- No stress with changes in the law – quitt Business stays up to date for you.

quitt Business does not replace any accounting tool

We take care of everything that concerns the employment and billing of employees, but have nothing to do with invoicing, for example. quit Business works perfectly with Bexio, Abacus, Banana, etc.

Among many other documents, quitt Business provides employment contract, team contract and expense regulations. You are free in the structuring of these documents, can adapt them to your own wishes and requirements and upload them to your customer area.

More about employment contract, team contract and expense regulations