Be it birthday or Christmas, say thank you to your employees on special occasions! Some presents are subject to AHV,…

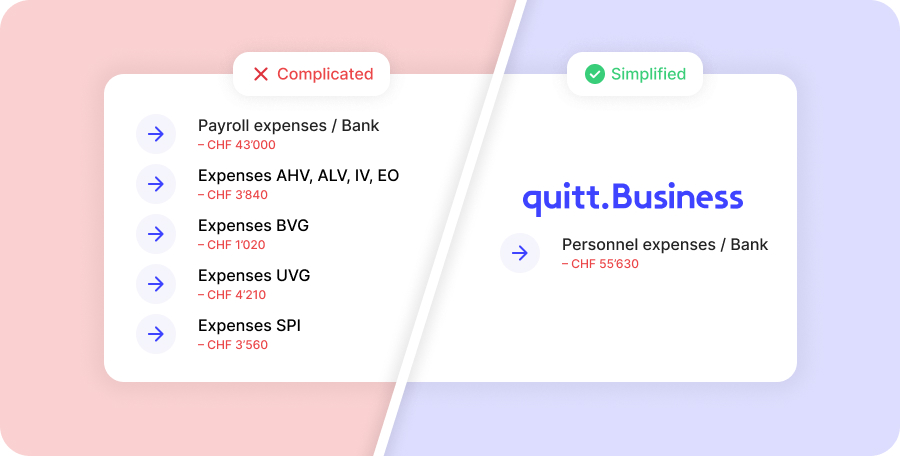

Internal or external payroll accounting?

The processes involved in payroll accounting are time-consuming and therefore costly. Instead of acquiring the knowledge themselves or hiring employees with specialist knowledge, many entrepreneurs decide to outsource their payroll accounting. Below are the advantages and disadvantages of internal or external payroll accounting.

Calculate wage deductions for free

Calculate your employees’ payroll with our free payroll calculator.

CALCULATE PAYROLL DEDUCTIONSAdvantages of outsourced payroll accounting

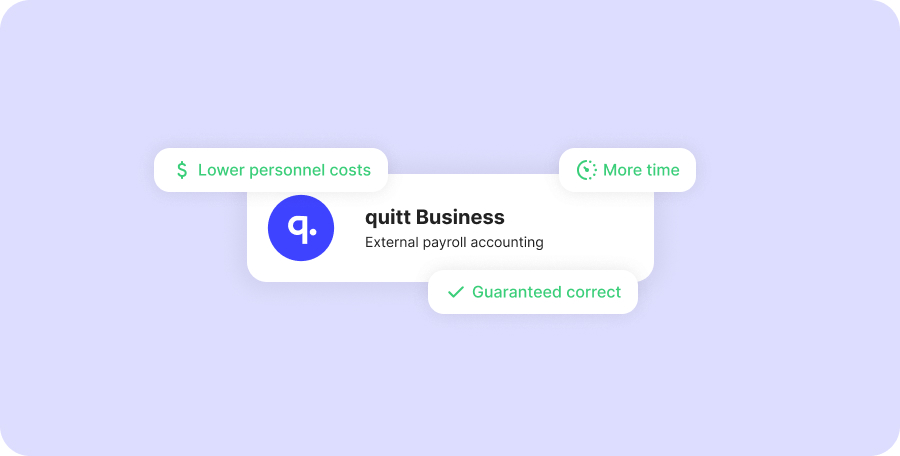

- Lower personnel costs

No need to employ an accountant.

- No software costs

The payroll software is provided by the trustee.

- More time for the core business

You don’t have to acquire the required knowledge yourself.

- Guaranteed correct

Accident reports, family allowances and source tax are part of everyday life.

Advantages of internal payroll accounting with payroll software

- In-house expertise

The technical expertise is covered by own employees.

- Control

Direct control over everything to do with payroll accounting.

No single solution is better than another, as the decision depends on individual needs and requirements. While founders with experience in payroll accounting may want to do it themselves using payroll software, other founders will look for a suitable solution to outsource it due to a lack of time.

A cost comparison pays off

In principle, we believe that it is worth outsourcing payroll accounting, especially for very small companies. Internal payroll accounting can make sense if the needs and processes of many employees become more complex and individualized.

The prerequisite for efficient outsourced payroll administration is, of course, that external payroll accounting is offered at a fair price. Just as with internal payroll accounting, you also pay an external service provider indirectly for their time and software costs. The average hourly rate of a trustee is CHF 120 – 250 per hour, although payroll administration is often offered at a flat rate (source: Gryps). It is essential to check which services the flat rate includes in detail – e.g. special cases such as source tax and family allowances or support with questions – as otherwise unforeseen additional costs may be incurred.

| Type of payroll accounting | Costs |

|---|---|

| Internal payroll accounting | Own time Personnel costs Software costs |

| External payroll accounting | Service provider costs |

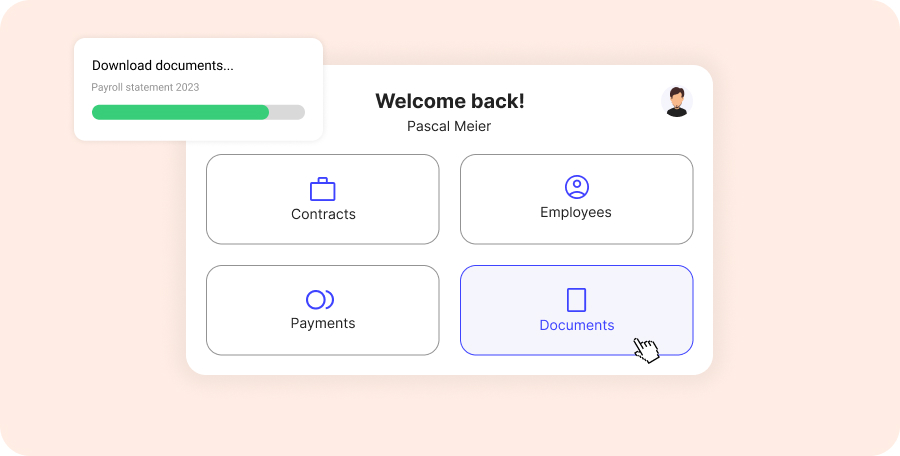

Payroll accounting with quitt Business

For CHF 19 per employee plus 0.1% commission per insurance selected, quitt Business takes over:

- Complete payroll accounting included:

Registration for source tax

Application for family allowances

Wage payment

Settlement with compensation fund & insurance companies

Creation of payroll accounting & wage statement

- Additional services included:

Selection of insurance partners

Taking out the necessary insurance policies

Complete handling of claims

Individually generated employment contracts

Individually generated team contract

Individually generated expense regulations

Daily support via chat, email and telephone

Payroll journal & cost overview

Access to web app by employer and employee

The above list shows that our service goes beyond that of a typical payroll service provider. In addition, we take on tasks relating to employment contracts and insurance, where legal advisors and insurance brokers are typically also involved.

Calculate wage deductions for free

Calculate your employees’ payroll with our free payroll calculator.

CALCULATE PAYROLL DEDUCTIONS