Be it birthday or Christmas, say thank you to your employees on special occasions! Some presents are subject to AHV,…

quitt Business simplifies financial accounting

AGs, GmbHs, and associations are obliged to keep accounts in Switzerland. This article shows how quitt Business simplifies your bookkeeping. Whether managed internally or with the help of a trustee, suitable for any accounting software.

Calculate wage deductions for free

Calculate your employees’ payroll with our free payroll calculator.

CALCULATE PAYROLL DEDUCTIONSAccounting obligation

In Switzerland, limited companies (AG, limited liability companies (GmbH) and associations are obliged to keep accounts under the rules defined in the Swiss Code of Obligations (Art. 957ff.). The accounting obligation means that an inventory, a complete balance sheet and an income statement with all supporting documents must be prepared.

Payroll accounting is a sub-area of accounting and is responsible for recording, settling and posting wages and salaries. Wages are in turn posted to the income statement and ultimately have an impact on the company’s balance sheet.

Employee or trustee?

Bookkeeping can be managed internally by an employee or, typically, be outsourced to a trustee. Financial and payroll accounting require in-depth accounting knowledge and are time-consuming, which is why many entrepreneurs decide to outsource their payroll and financial accounting or just their payroll accounting. In practically every case, the person doing the bookkeeping uses accounting software such as Bexio, Run my Accounts, Banana or CashCtrl for support.

| Internal or external? | Requirements |

| Internal accounting | Know-how, time, accounting software |

| External accounting | Right partner, budget |

Just one accounting record

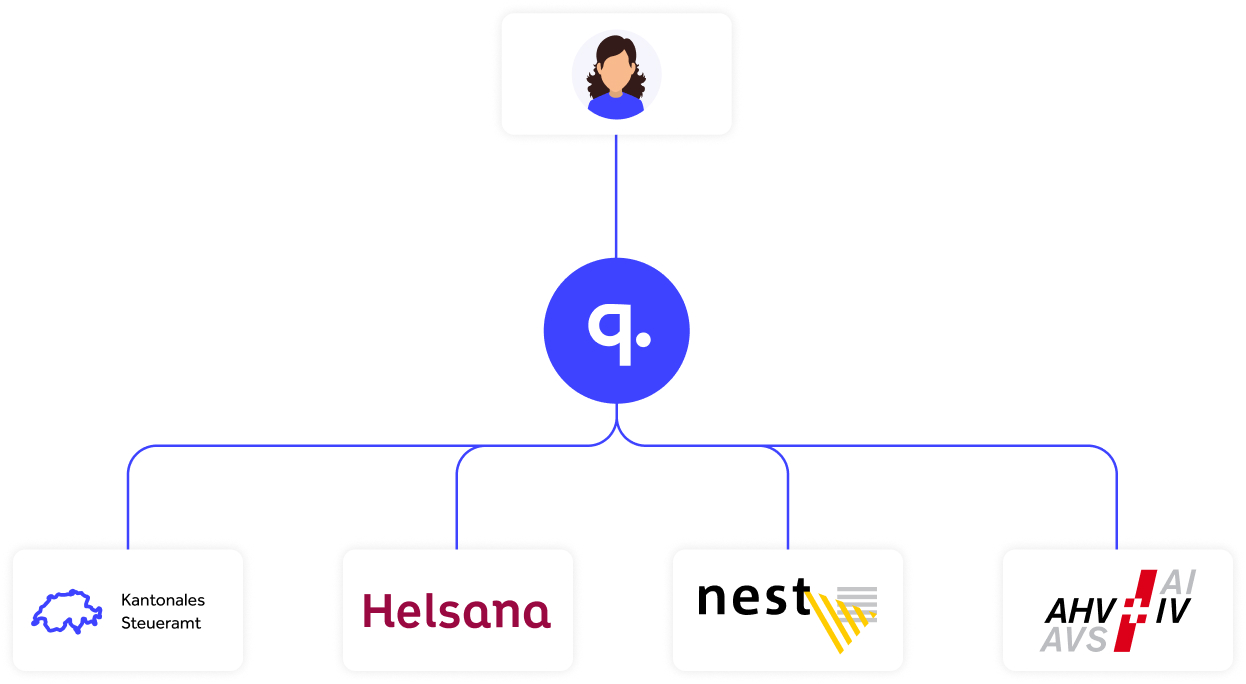

quitt Business takes care of all registrations and correspondence with the authorities and insurance companies for you in the area of payroll accounting, as well as the correct accounting and payment of wages on an ongoing basis, including all payroll documents. You top up your customer account using the prepaid method and we use it to pay your wages and taxes.

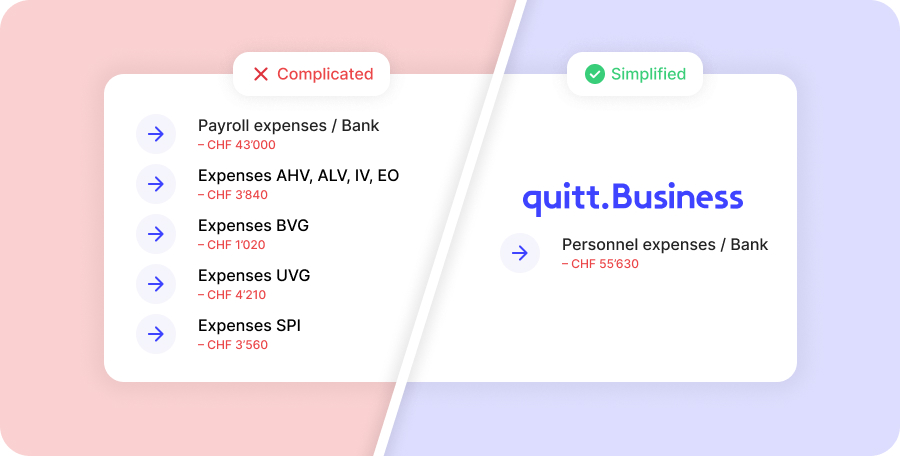

As described in the first section, these wages and contributions must then be shown in the financial accounting. They are relevant to earnings and a possible audit must be able to trace the correct settlement of wages with the compensation fund and the pension fund. Traditionally, the following accounts are used for personnel expenses in financial accounting:

- Wage expenditure

- Bonuses

- 13th monthly salary

- Expenses AHV, ALV, IV, EO

- Expenses FAK

- Expenses BVG

- Expenses UVG

- Expenses SPI

- Expenses UVG supplement

If you decide to outsource your payroll accounting to quitt Business, this will simplify your financial accounting considerably. For auditing reasons, you then no longer need to break down the wages in your financial accounting, as everything is already stored accordingly in quitt Business. A single posting record is sufficient in financial accounting:

- Personnel expenses / Bank

In the event of a payroll audit, the payroll journal can be downloaded from quitt Business and presented at any time. This means that regardless of whether you do the financial accounting yourself or are supported by a trustee, quitt Business saves you several hours of work in this regard. If you still want to show all accounts in the financial accounting, this is of course no problem. You can simply download the Excel file of the payroll journal and transfer the values of the individual personnel expense accounts to your financial accounting.