No registration, no benefits. This article explains how to register your employees with the AHV and what you should bear…

Calculate payroll deductions: What you need to know

Every employer must make statutory deductions from the wages of his employees. These are accounted for as employer and employee contributions. In this article, we will show you exactly which wage deductions are involved with the current rates from 1.1.2023.

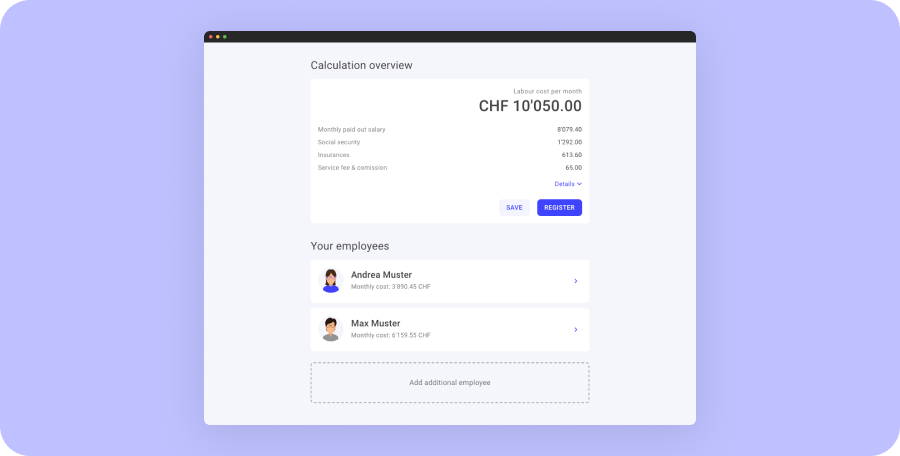

Calculate wage deductions for free

Calculate your employees’ payroll with our free payroll calculator.

CALCULATE PAYROLL DEDUCTIONSWage deductions – employee and employer deductions

Each employee is awarded a certain wage amount in the job interview and this amount is contractually fixed: the gross wage. The gross wage is a purely calculated figure to which all employee contributions relate. Only after the deduction of the employee contributions does the wage result that is transferred to the employee’s account at the end of each month: the net wage.

The employee contributions are:

- Old-age and survivor’s insurance (OASI)

- Disability insurance (DI)

- Loss of earnings compensation scheme (EO) (for military and maternity)

- Unemployment insurance (ALV)

- Law on occupational pension schemes benefits (LPP) (ab CHF 22’050 pro Jahr)

- Sick pay insurance (SPI) (bei BVG-pflichtigem Lohn)

- Non-occupational accident insurance (NOAI) (ab acht Arbeitsstunden pro Woche)

The employer must also make contributions. The total wage costs for an employee include the net wage as well as the deductions for the employee and employer contributions.

The employer contributions are:

- Alters- und Hinterlassenenversicherung (AHV)

- Invalidenversicherung (IV)

- Erwerbsersatzordnung (EO) (bei Militär und Mutterschaft)

- Arbeitslosenversicherung (ALV)

- Berufliche Vorsorge (BVG), auch “Pensionskasse” genannt (ab CHF 22’050 pro Jahr)

- Sick pay insurance (SPI) (bei BVG-pflichtigem Lohn)

- Occupational accident insurance (OAI)

- Familienausgleichskasse (FAK)

- Administrative expenses of the compensation office

Find out your employees’ payroll deductions with our intuitive payroll calculator – clear and direct.

The individual wage deductions at a glance

AHV/IV/EO

- 10.6% (5.3% employee contribution, 5.3% employer contribution)

- The obligation to pay contributions begins on January 1 after the employee’s 17th birthday and ends when the employee stops working. The employer is responsible for registering the employee.

- AHV/IV/EO werden immer zusammen abgezogen.

Further information on contributions to AHV, IV, EO

Further information on registering your employees with AHV

Unemployment insurance (ALV)

- 2.2% up to CHF 148’200 annual income (1.1% employee contribution, 1.1% employer contribution)

- As of 1.1.2024, no ALV contributions are due on annual incomes above CHF 148’200.

Further information on contributions to ALV

Pension fund (BVG)

- The obligation to contribute begins with an income of more than CHF 1’837.50 per month or CHF 22’050 per year.

- The contribution amount depends on the gross salary, age and degree of employment of the employee as well as on the employer’s pension plan.

- The employee and the employer pay half of these contributions.

With quitt Business, the calculation of the pension benefit is based on the guidelines of the Nest Collective Foundation.

Further information on the obligation to join a pension fund

Further information on our pension fund partner Nest Collective Foundation

Sick pay insurance (SPI)

- If the employee has a salary subject to BVG, a SPI must also be taken out.

- The employee and the employer pay half of these contributions.

With quitt Business, the insurance premiums for the SPI amount to 0.1% of the settled gross salary. The insurance partner is Helsana Insurance.

Further information on continued payment of wages in the event of illness

Further information on our insurance conditions

Further information on our insurance partner Helsana Insurance

Accident insurance (AI)

Occupational accident insurance (OAI)

- All individuals who are employed in Switzerland are compulsorily insured against occupational accidents through their employer. The amount of the premium depends on the risk of the occupation.

- The costs for the OAI are borne by the employer.

Non-occupational accident insurance (NOAI)

- From eight hours of work per week or more for the same employer, insurance against non-occupational accidents is also mandatory.

- The costs for the NOAI are borne by the employee.

With quitt Business, the insurance premiums for AI amount to 0.1% of the gross salary. The insurance partner is Helsana Insurance.

Further information on the mandatory accident insurance

Further information on our insurance conditions

Further information on our insurance partner Helsana Insurance

Family allowances (FAK)

- The contribution rate is 1.08 – 2.65% and varies depending on the canton.

- Minimum rate for child allowances: CHF 200 (for children up to 16 years of age or until they are entitled to the education allowance).

- Minimum rate for education allowances: CHF 250 (for young people undergoing post-compulsory education; from age 15 the earliest, up to age 25).

- The employer pays the contributions.

Administrative expenses

- Compensation funds charge a contribution to administrative costs for their activities.

- The amount of the contribution varies depending on the compensation fund and amounts to a maximum of 5% of the OASI/DI/EO contribution amount.

Calculate wage deductions for free

Calculate your employees’ payroll with our free payroll calculator.

CALCULATE PAYROLL DEDUCTIONS