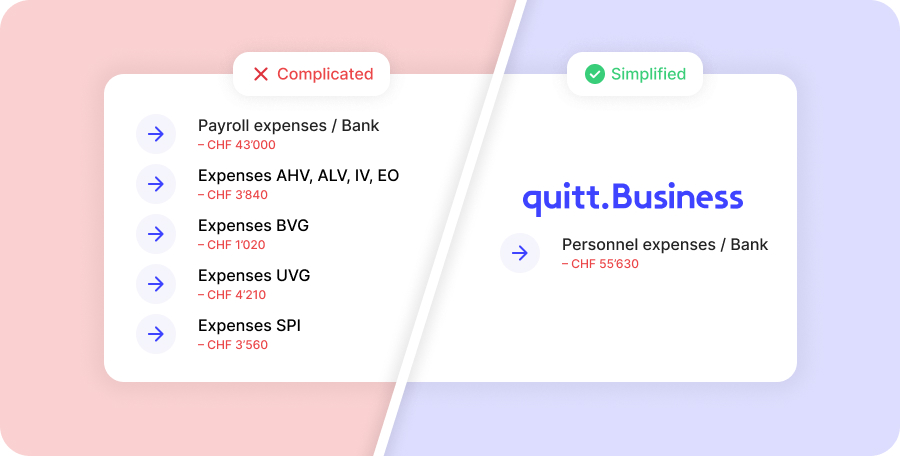

AGs, GmbHs, and associations are obliged to keep accounts in Switzerland. This article shows how quitt Business simplifies your bookkeeping…

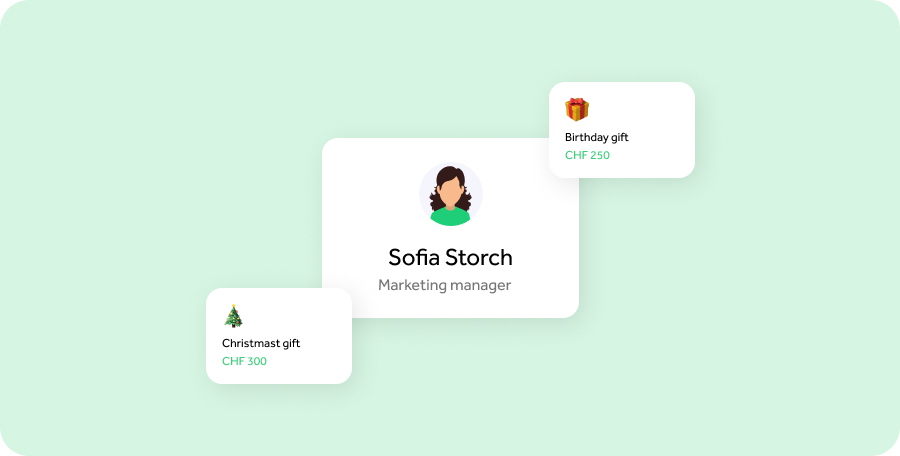

Make your employees a present

Be it birthday or Christmas, say thank you to your employees on special occasions! Some presents are subject to AHV, others are not. Therefore, the question: What can I give to my employees without hesitation and what needs to be declared on the pay slip?

For many people, birthdays or Christmas are among the most enjoyable occasions of the year. Whether in a close family circle or among colleagues at work – presents that come from the heart can bring a smile to every face. A lot of employers surprise their employees with small gifts for their birthdays or invite them to company Christmas parties, both of which are highly appreciated by employees. Every little bit of gratitude on the part of the employer is a sign of thank you and recognition for the valuable commitment shown by the employees.

Are presents subject to AHV?

As an employer, however, you must adhere to certain rules when it comes to giving presents. It is often forgotten that gifts in kind may be subject to AHV contributions and should be declared on the pay slip.

As a general rule, all event-related gifts for birthdays, Easter, Christmas, weddings, childbirths, anniversaries, etc. up to a value of CHF 500 per occasion can be given to employees without hesitation. Such gifts are not part of the pay slip and exempt from AHV contributions and taxes.

Likewise, the following benefits do not have to be declared:

- Free half-fare travel cards issued by SBB

- REKA cheque discounts of up to CHF 600 per year

- Private use of work tools such as mobile phones, computers, etc.

It is important to note, however, that the entire value of a present is subject to AHV contributions and tax as soon as the exemption limit of CHF 500 is exceeded. If an employee receives a present worth CHF 700, the whole amount must be accounted for and not just the CHF 200 which exceed the exemption limit of CHF 500.