Be it birthday or Christmas, say thank you to your employees on special occasions! Some presents are subject to AHV,…

Registering employees with the AHV: What you need to know.

No registration, no benefits. This article explains how to register your employees with the AHV and what you should bear in mind.

This is what it’s all about

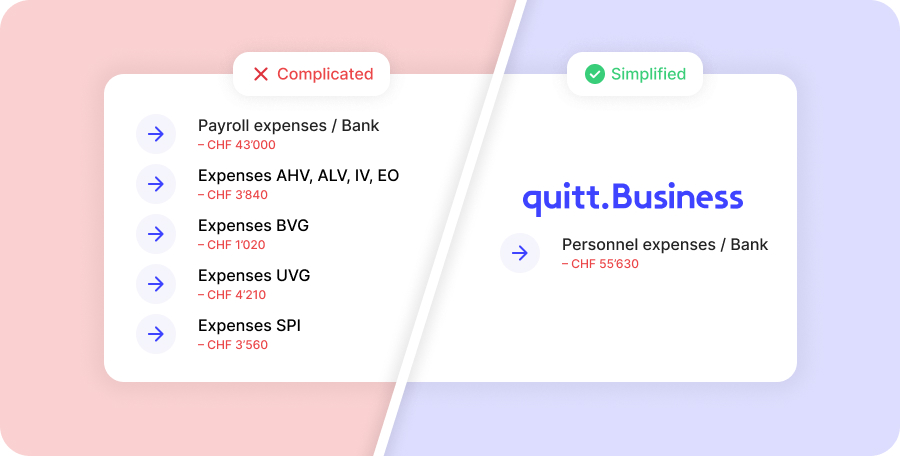

- Every company has to settle social insurances (AHV, IV, EO, ALV) for its employees.

- For this purpose, each company must register with a compensation fund (AK) using a form. There are over 50 association compensation funds and 26 cantonal social insurance institutions (SVA).

- In case of very small employment of less than CHF 2’300 per year, settlement can be waived with the agreement of both parties (does not apply to private households).

What deadlines do I have to meet?

The obligation to pay contributions begins on January 1 after the 17th birthday and ends with the end of gainful employment. If gainful employment is discontinued before the regular retirement age (for women at age 64, for men at age 65), there is an obligation to pay contributions for persons not in gainful employment. Persons above the regular retirement age remain liable to pay contributions but benefit from an allowance.

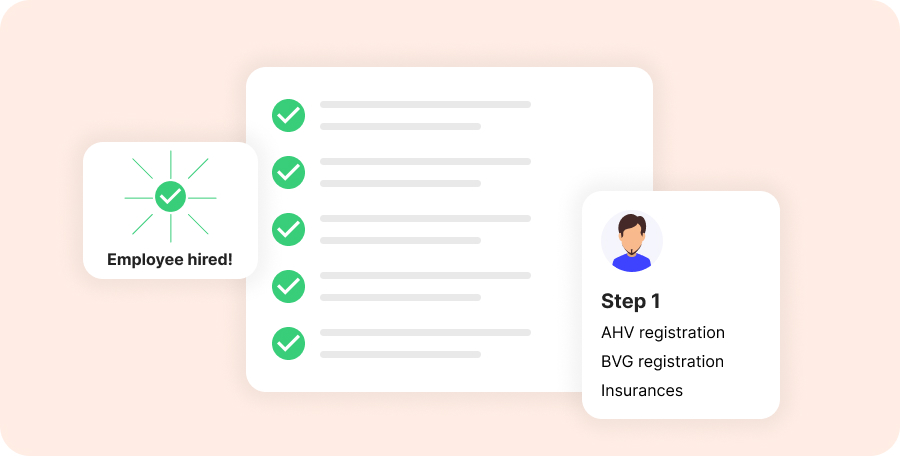

The employer is responsible for registering new employees with the compensation office and has 30 days from the start of employment to do so.

Additional employees can be hired during the current calendar year, even without notifying the SVA during the year. These new employees are registered with the compensation office with the end-of-year declaration.

How do I register with the AHV?

Most companies register with the cantonal compensation fund. Association compensation funds exist for special, more established industries, such as banks, the dairy industry or the watch industry.

Here, you will find the relevant forms for AHV registration. Too complicated? Then simply register with quitt Business – we will take care of that and everything else for you.

How much are the deductions for AHV, IV, EO and ALV?

The contributions in 2023 are:

- AHV: 8.7%

- IV: 1.4%

- EO: 0.5%

- ALV: 2.2%, only liable to pay contributions up to annual income of CHF 148’200

Who pays the social security contributions?

The social security contributions (total: 12.8%) are paid half by the employer (6.4%) and half by the employee (6.4%). But this division exists only on paper. The employee always receives a net wage and the employer transfers the employer and employee contributions.

- Gross salary:

The gross salary is the wage that is awarded to an employee in the job interview and fixed in the employment contract. Ultimately, it is a purely calculated figure that exists only on paper, because this amount is neither paid out nor does it correspond to the total costs. All percentages of social security contributions refer to the gross salary. - Net salary:

The net salary is the wage paid to the employee’s account at the end of each month. It is the amount left after deducting social security contributions from the gross salary. - Total costs:

The employer pays net wages + employer contributions + employee contributions.

Are there any other deductions?

Yes. In addition to social security contributions, other taxes must be paid:

- Pension fund (PK) (also called “occupational pension plan (BVG)”)

- Accident insurance (UVG)

- Sich pay insurance (KTG)

More information on payroll deductions

Register Employees with AHV

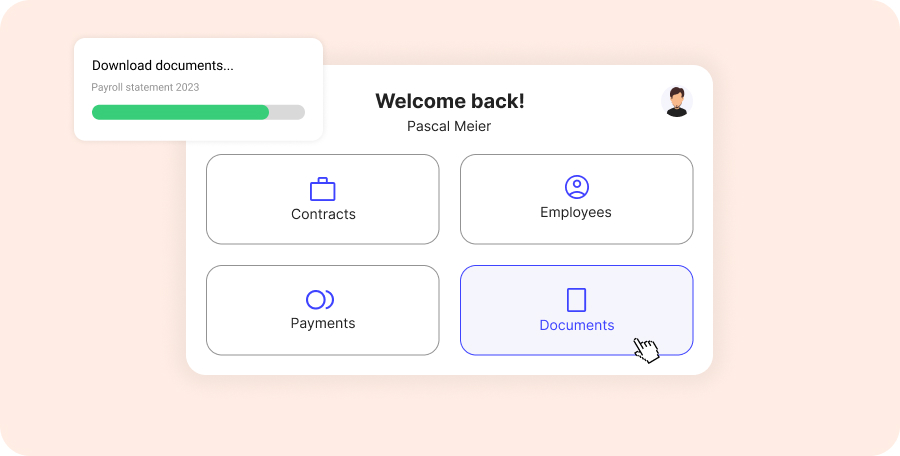

We register all your employees with AHV, insurance, and the pension fund and take care of the entire payroll management.

SIGN UP NOW