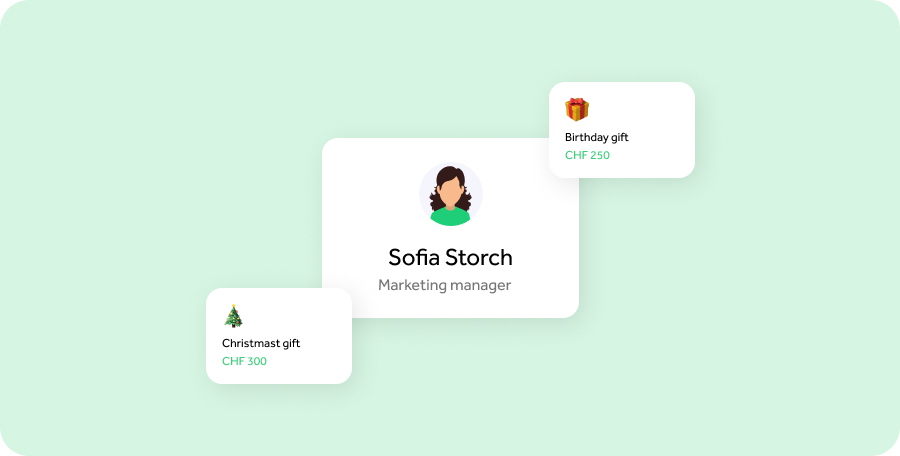

Be it birthday or Christmas, say thank you to your employees on special occasions! Some presents are subject to AHV,…

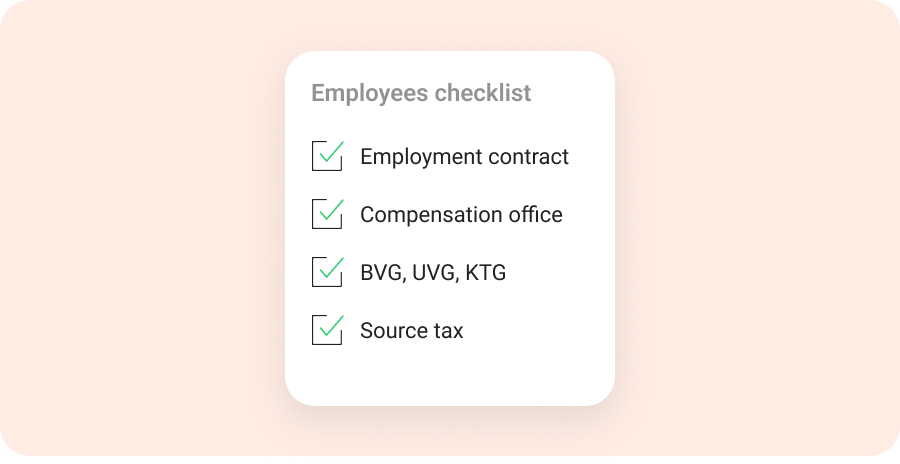

Checklist for hiring new employees

As a founder, you are quickly confronted with the hiring of employees. Even you yourself, if operationally active, are an employee of your company from the very beginning. The following checklist shows step by step, what you need to think about as an employer and which obligations you have to fulfill.

Download checklist for free

Download our Starter Package for free and get all the necessary documents for the administration of your new employees

DOWNLOADChecklist for hiring employees:

- Creation of the employment contract

- Registration with the compensation office

- Conclusion of BVG, UVG and possibly KTG, UVG-Z

- Obligation for notification and authorization under the law relating to aliens

- Application for source tax

- Application for family allowances

- Salary payment

- Payroll accounting with the compensation office

- Preparation of the salary statement

1. Creation of the employment contract

An employment contract may be concluded orally, in writing or tacitly. To avoid ambiguity, it is recommended that it be in writing. The written form may also be requested by the employee at any time.

By signing the employment contract, the employer undertakes to pay a salary, to pay social security contributions and to guarantee paid leave. The employee, on the other hand, undertakes to perform the work specified by the employer. In addition, the employee is subject to a duty of loyalty and care after the conclusion of the contract. The employment contract should contain at least the following points:

- Name and address of employer and employee

- Duties and responsibilities of the respective position

- Start and duration of the contract

- Gross salary, monthly deductions, allowances, 13th month salary

- Workload, working hours, overtime, night work

- Notice period in compliance with the provisions of OR Art. 335a ff.

- Vacation, public holidays, rest days, educational leave

In addition, it must be taken into account whether the company is subject to a collective labor agreement (CLA). If this is the case, the provisions of the CLA must be complied with. When hiring minors, you must also be able to present the (written) declaration of consent of the parents or the legal representative.

Based on the information you provide, quitt Business will draw up employment contracts, a team contract and the expense regulations for you.

Click here for the standard employment contract

FAQ on private employment law (in German)

Further information on collective agreements (in German)

2. Registration with the compensation office

People who are employed in Switzerland must pay contributions to the first pillar (AHV), the IV and the EO. The obligation to pay contributions begins on January 1 after the 17th birthday. The employer is responsible for the registration. The obligation to pay contributions ceases if the person ceases employment.

The contributions to the AHV are paid in equal parts by the employee and the employer. The half to be paid by the employee is deducted directly from the salary and paid in together with the employer’s half. In addition to contributions to AHV / IV / EO, contributions to unemployment insurance (ALV) must also be paid. These contributions are also paid in equal parts by the employee and the employer. Employees must register for AHV / IV / EO and ALV contributions with the relevant cantonal compensation office at the company’s place of business or, if you are a member of a professional association that runs its own compensation office, the relevant association compensation office. Usually, these offices also run a family compensation office. Exceptions exist for employees who do not yet turn 18 in the calendar year in question and for old-age pensioners.

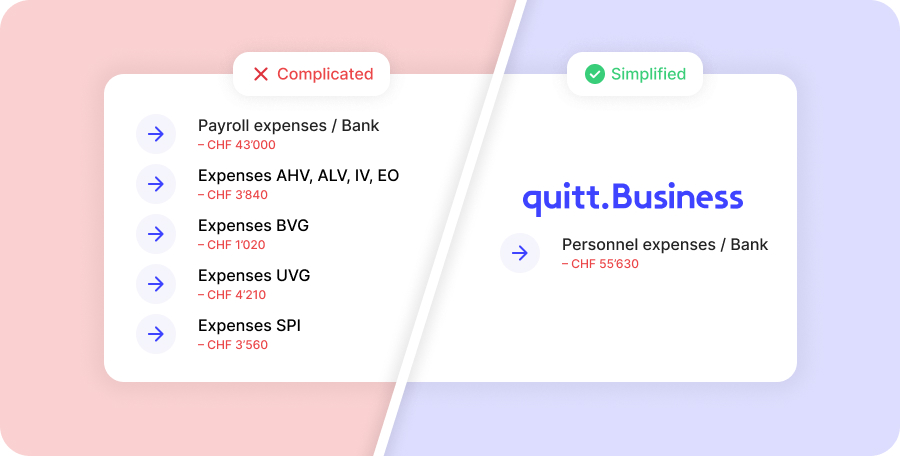

quitt Business will take care of all the above registrations and settlements with the compensation office for you.

Further information on contributions to AHV, IV, EO, ALV

3. Conclusion of BVG, UVG and possibly KTG, UVG-Z

As an employer, you may be obliged to join a registered pension scheme and to insure your employees against accidents in any case. Taking out daily sickness benefit insurance is voluntary, but recommended in most cases.

Occupational pension plan (BVG):

Contributions to the 2nd pillar of the occupational pension plan must be made on salaries that are subject to the AHV contribution obligation and that exceed CHF 22’050 per year. Employers must join a registered pension fund. For employees who turn 18 in the calendar year in question, the obligation to register exists from the first of January of that year. Employees of normal statutory retirement age are not required to register. The amount of contributions to the pension fund depends on the employee’s salary and age and the employer’s pension plan.

Accident insurance (UVG):

All persons employed in Switzerland are compulsorily insured against accidents through their employer. Employees who work more than 8 hours a week for the same employer are insured not only against occupational accidents (BU), but also against non-occupational accidents (NBU).

Sick pay insurance (KTG):

KTG insurance for employees is not mandatory. However, KTG insurance is worthwhile for the employer in most cases. This is because employers are legally obligated to continue paying employees’ wages for a certain period of time in the event of illness. Without KTG insurance, the employer himself bears the risk of having to pay the salary without receiving any work performance.

Supplementary accident insurance (UVG-Z):

Mandatory accident insurance provides adequate protection in most cases. A voluntary UVG-Z can provide additional protection.

quitt Business takes care of the connection to the pension fund, the conclusion of all necessary insurances and the handling of claims.

More information on quitt Business insurances

More information on the obligation to join a pension fund

More information on compulsory accident insurance

More information on continued payment of wages in case of illness (in German)

4. Obligation for notification and authorization under the law relating to aliens

In many cases, the exercise of gainful employment by foreign nationals in Switzerland is subject to notification or authorization requirements under immigration law. Employers are responsible for complying with most of the reporting and authorization requirements in connection with an employment relationship. In certain cases, however, employees are also subject to reporting and authorization obligations.

Employers’ obligation for notification and authorization under the law relating to aliens:

- Emlpoyment of EU/EFTA for a work period of up to 90 days per calendar year (uninterrupted or on a daily basis): obligation to register.

- Employment of workers from third countries: permit requirement.

Employees’ obligation for notification and authorization under the law relating to aliens:

- The exercise of paid employment by EU/EFTA nationals or by an employer domiciled in Switzerland for a period of more than 90 days per calendar year (continuously or on a daily basis) is subject to authorization. The obligation to obtain the permit rests with the employee.

More information on employees’ obligation for notification and authorization under the law relating to aliens (in German)

quitt Business does not take over any notifications and authorizations for you according to the law on foreigners.

5. Application for source taxes

In contrast to the normal tax, the withholding tax is not paid directly by the taxpayer, but by the employer. The withholding tax is deducted from the salary before it is paid. The employer is obliged to report the employment of persons liable to withholding tax to the competent tax authority within 8 days of the commencement of employment and to settle the withholding tax with the tax authority.

quitt Business takes care of all necessary registrations and settlements in connection with the withholding tax.

More information on cases and requirements for source tax liability (in German)

6. Application for family allowances

Employees with children may be entitled to child allowances. The employer must apply for child allowances from the relevant family compensation fund. As a rule, the family compensation fund is managed by the employer’s AHV compensation fund.

quitt Business takes over the application and payment of all family allowances for you.

More information on family allowances

7. Salary payment

The employer must pay the employee the wage that is agreed, customary or regulated by a standard employment contract (NAV) or collective employment contract (GAV). There are still no statutory minimum wages for Swiss citizens. However, such minimum wages may result from provisions in a NAV or GAV. As a rule, a time wage is agreed, i.e. the wage is determined according to the hours worked. In the case of weekly or monthly wages, holiday and rest days are usually not taken into account, i.e. the wage always remains constant, regardless of the month for which it is paid. Unless shorter periods or other dates are agreed or customary, and unless otherwise stipulated by NAV or GAV, the wage must be paid to the employee at the end of each month. The employee is therefore obliged to pay in advance, but is entitled to have the agreed wage in his possession by the end of the month at the latest. The employee shall be provided with a written statement of account. Together with the wage, the employee must therefore be given a complete and comprehensible monthly wage statement (gross wage, deductions, net wage paid). It is advisable to also list vacation and, if applicable, overtime credits on the respective pay stub. Payroll deductions: The employer is responsible for deducting the employee’s share of social security contributions.

quitt Business takes care of the correct calculation, accounting and payment of wages.

8. Payroll accounting with the compensation office

Wages must be settled with the compensation office by January 30 of the following year so that contributions can be determined and the entries credited to the individual employee’s accounts. The employer receives a settlement form from the compensation office for this purpose.

quitt Business takes care of all correspondence with and accounting to the compensation office for you.

9. Preparation of the salary statement

The employer must issue a wage statement to the employee after the end of the year.

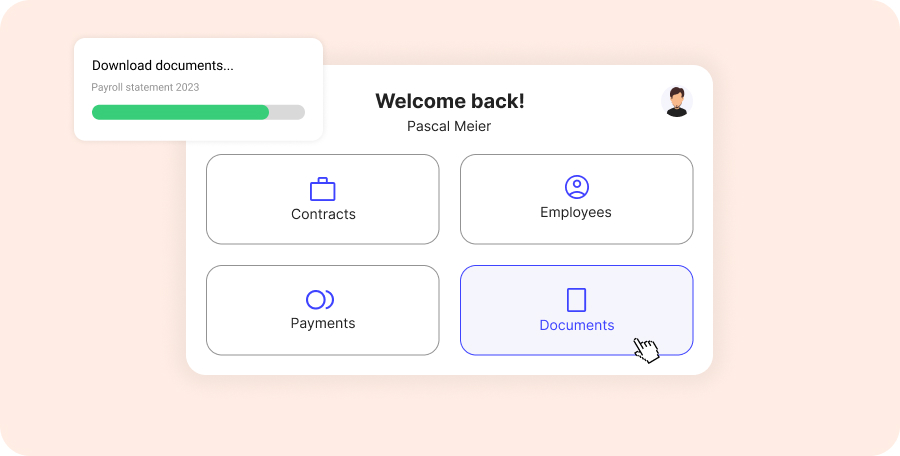

quitt Business creates all the necessary documents for you, including the wage statement, which are available for you and your employees to download.

More information on the salary statement

Hire Employees Now

We register all your employees with the social security office, insurance, and pension fund and take care of the entire payroll process.

REGISTER NOW